The sharp falls in gold prices have left central banks with theoretical losses of £429bn, it was estimated today.

The price of bullion has fallen a staggering 34% since its peak in August 2011, when an ounce was worth $1,895.

The total value of gold held in central bank vaults is now worth just £800bn, down from £1.27 trillion at the market peak.

The sharp falls in gold prices have left central banks with theoretical losses of £429bn, it was estimated today.

The price of bullion has fallen a staggering 34% since its peak in August 2011, when an ounce was worth $1,895.

The total value of gold held in central bank vaults is now worth just £800bn, down from £1.27 trillion at the market peak.

The Bank of England reserves are now valued at £8.2bn down from £12.4bn in August 2011 according to calculations by Banc De Binary, an options trading firm.

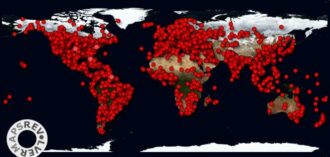

It said that the United States Federal Reserve had faced the largest losses – with the value of its holdings falling $323bn in August 2011 to $213bn this week. The US has the largest national gold reserves of any nation, making up 26% of all the gold held in central banks worldwide.

The Banc said that despite the falls both private and institutional investors still saw the asset class as a necessary hedge against hyperinflation and a safe haven in comparison to equities and bonds.

But Oren Laurent, chief executive of Banc De Binary, also said there were questions over whether central banks should still tie up so much money in a low yielding asset like gold.

“For central banks and governments, making decisions over when to exit gold is fraught with risks, and the potential for embarrassment is huge,” he said.

“Gordon Brown will never be allowed to forget the decision he made in selling off hundreds of tonnes of the UK’s gold reserves at what turned out to be near the bottom of the market.”

Demand for gold has steadily risen since 2000, with much of it due to developing nations using new-found wealth to fill their reserves with bullion. Increased popularity of gold jewellery, particularly in India, has also helped. Gordon Brown famously order the sale of much of Britain’s gold reserves – 400 tonnes – when he was Chancellor in 1999. It was sold between $256 and $296 an ounce.