The merger of Russia’s two largest gold producers could create a company on par with Canadian bullion digger Goldcorp (NYSE:GG,TSX:G), according to recent reports.

MINING.com reported that a combination of Polyus Gold (LSE:PGIL) and Polymetal International (LSE:POLY) is a likely outcome of last week’s news that Russian billionaire Mikhail Prokhorov is selling a 37-percent stake in Polyus to an unnamed group of investors selected by billionaire Suleiman Kerimov’s Nafta Moskva, which holds a 40-percent stake in Polyus.

Kerimov tried unsuccessfully to merge the two firms last year. If he succeeds this time, the resulting company will be the world’s fifth- or sixth-largest gold producer (on par with Canada’s Goldcorp), with over 2.7 million ounces predicted for 2013, according to MINING.com.

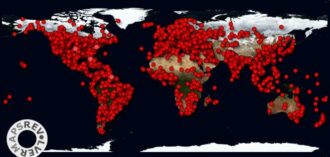

Canadian based Goldcorp (TSX: G) is the fastest-growing, lowest-cost senior gold producer, with operations and development in the Americas. In a recent report relating to its Aurora gold project in Guyana, Goldcorp outlined an open-pit, underground operation that will yield 194,000 ounces per year over a 17-year life of mine, with 231,000 ounces produced on average in the first 10 years.